Appraisals -- What Do You Know About Them?

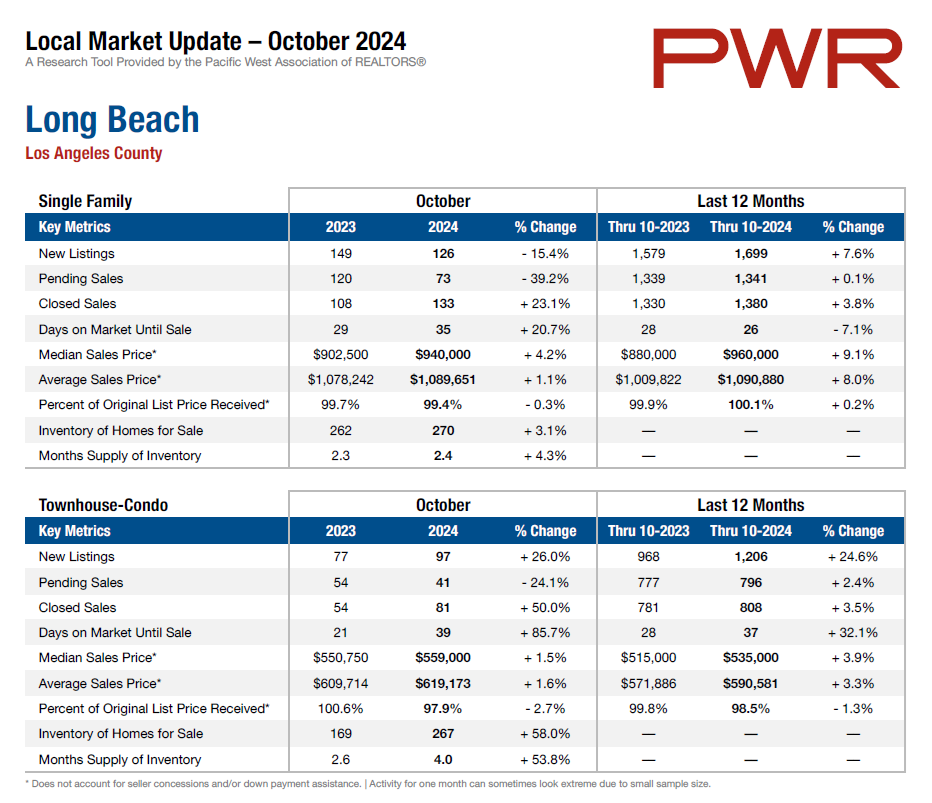

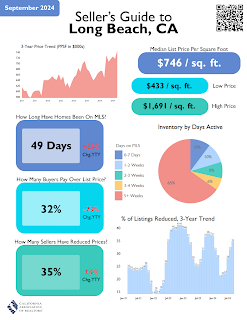

Sellers have been in a multiple offer market again this year, with buyers getting the "Buy Now" feeling in order to get a home. But buyers nevertheless want a good value, and appearance, condition and location are still extremely important. That all goes into value for the buyer.

So sellers, pricing your property for sale goes hand-in-hand with preparing your property for sale, which ultimately can affect the perceived value and thus, the sold price, of the property.

The buyer's lender's appraiser will have the ultimate word for value -- yes, theoretically it's possible to appeal but most often that is not successful, or it may require the buyer finding another appraiser, at buyer's cost.

Many sellers are familiar with "comparables" - but what goes into that word? It means they must be within the area, similar properties and recent active, pending and solds. Remember, an appraisal is an "opinion of value", so opinions may vary somewhat from one professional to another. Usually, about 6 properties are selected. Closed sales must be within last 6 months, maybe more recent within last 90 days, within one mile, and within 20-25% of the property's living area square footage (GLA). If the buyer is obtaining a conventional loan, all square footage must be permitted to be included in the appraisal; an FHA loan requires "permittable" square footage. Have you heard of bracketing? That's where properties both lower and higher in value, less and more in GLA, lot size, possibly age and other physical characteristics such as upgrades and remodels, are used as comparables. So, for example, a 900 sq. foot house is not compared to a 2500 sq. foot house. And the appraised value of your home cannot be higher than the highest priced sold comparable. So comparable selection is important, and if it's difficult, i.e., due to lack of recent sales or listings, to find them meeting all the selection criteria, the appraiser has to justify a different selection in written remarks.

Living areas don't include, for example, a guest house, patio room or the garage. And, a long held belief is that in order to a bedroom to be qualified as such, it must have a closet -- but that's not true according to the International Residential Code. To qualify, a bedroom must be over 70 sq ft, have a minimum 7 ft of wall length, at least 2 methods of egress including doors and windows to the outside, and have at least 7 ft ceiling height in at least one-half of the room. It doesn't have to have a closet.

Sellers, the more information you can share about the property, the more your Realtor can assist the appraiser, because not all information is readily available on the MLS listing. Provide your agent with a list of improvements: what, when, cost, and any p ermits for additions which you physically possess or obtain online, the name and phone number of any HOA property manager, HOA information on dues and amenities. Your agent will be able to provide area comparables and copies of any multiple offers, plus a copy of your contract with the buyer.

This post if about the general basics of appraisals, there can be other factors to consider, such as a fastward moving up or down market.

If you would like more information about pricing your property and get the opinion of a real estate professional who's been licensed since 1994, please contact me via phone, text, or email!

Julia Huntsman, REALTOR, Broker | http://www.juliahuntsman.com | 562-896-2609 | California Lic. #01188996

Your Market Info