California Housing Market for September, and 2023 Annual Prediction

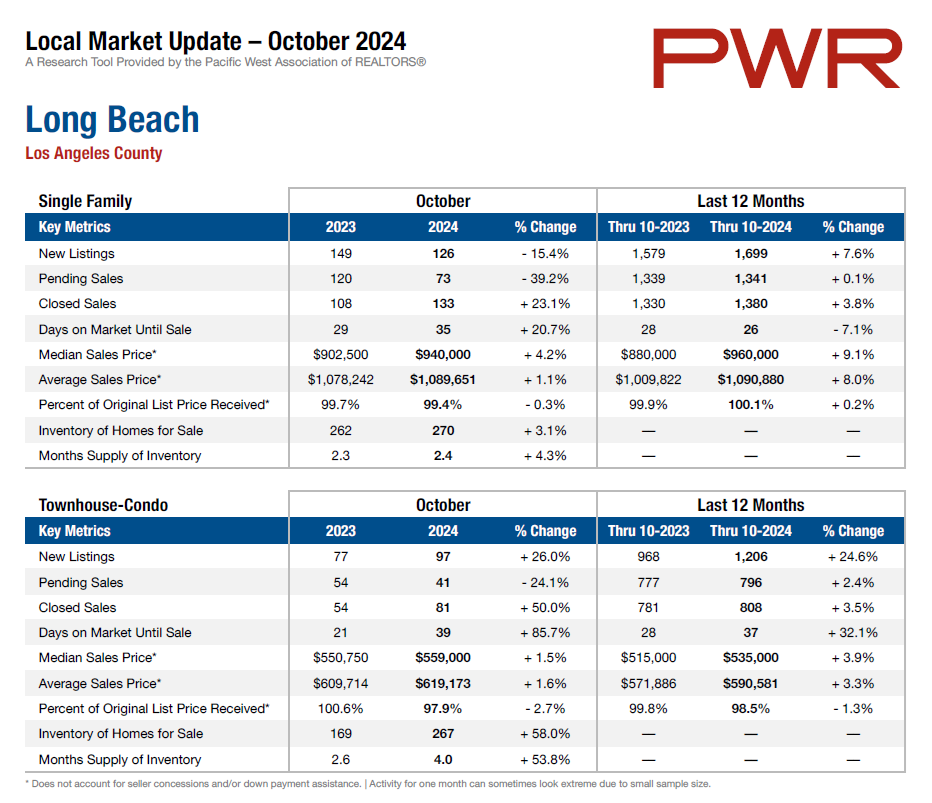

According to California Association of Realtors report on current sales and pricing for September, the existing home price in September for Southern California was $783,380, a year to year increase of over 3%, but existing home sales slipped since last May and are down over 32% year to year. Sales dipped as rates climbed - pending sales fell more than 40% as mortgage rates hit 20-year high.

|

| So Calif Housing Prices/Sales |

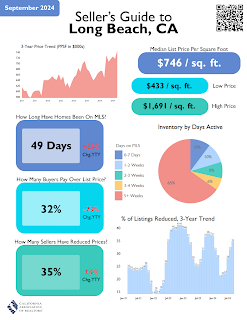

The California median price is up from last year, but dipped to a seven month low, $821,680 and the median price for a condo/townhome is $620,000. The sales price to list ratio dipped to the lowest level since 2019, and the share of homes selling above asking price was 28.3% vs. 72% in the Spring of 2022.

In Los Angeles County in September, approximately 30% of homes sold over list price, the highest being San Francisco County at 64%.

While inventory slipped a little, it's still comparable to pre-pandemic levels of being under 3 months (normal is 6 months, not seen since 2012). Active listings have increased over last year but still lower than 2018 and 2019. Southern California has seen the largest growth in active listings over all other California regions. Time on market was a median of 22 days, double that of one year ago. Sales to list price ratio was 97.7%. The median reduction amount for reduced price listings was 5.6% while 44.5% of listings had a reduced price.

|

| 2023 Calif Housing Forecast |

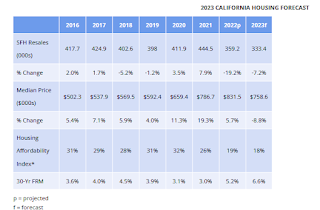

The October annual CAR forecast at the Long Beach Convention Center predicts an overall softening of the housing market for 2023 by about 7%, where the median price is $758,000 vs. the current $821,680. This may be a relief for some buyers, however the 30-year Fixed Interest Rate is predicted at 6.6%, and in recent days has threatened to increase even more. Buyers may be interested to know that mortgage lenders are bringing back programs that will help some buyers with grants, etc., to help their buying process.

Julia Huntsman, REALTOR, Broker | http://www.juliahuntsman.com | 562-896-2609 | California Lic. #01188996

Your Market Info