A Slowing of Rate Increases, Finally?

"Indeed, the statement released by the FOMC pointed to “ongoing increases

in the target range” in order to bring inflation back to the Fed’s 2%

target. New economic projections issued Wednesday by the central bank

revealed that officials now anticipate inflation to close this year at

4.8%, gradually dwindling back to 3.5% in 2023 and falling to 2.5% in

2024." The Fed's policy rate is now at 4.5%, the highest since 2007. https://www.scotsmanguide.com/browse/content/fed-finally-backs-off-of-75basispoint-hikes-with-december-rate-increase

However, the federal funds rate and mortgage rates sometimes move in opposite directions, such as in early December when mortgage rates fell in response to declining inflation. " Although there's merely an indirect link between mortgage rates and the federal funds rate, the Fed does have a direct influence on the rates charged on home equity lines of credit, which typically have adjustable rates." https://www.nerdwallet.com/article/mortgages/fed-mortgage-rates

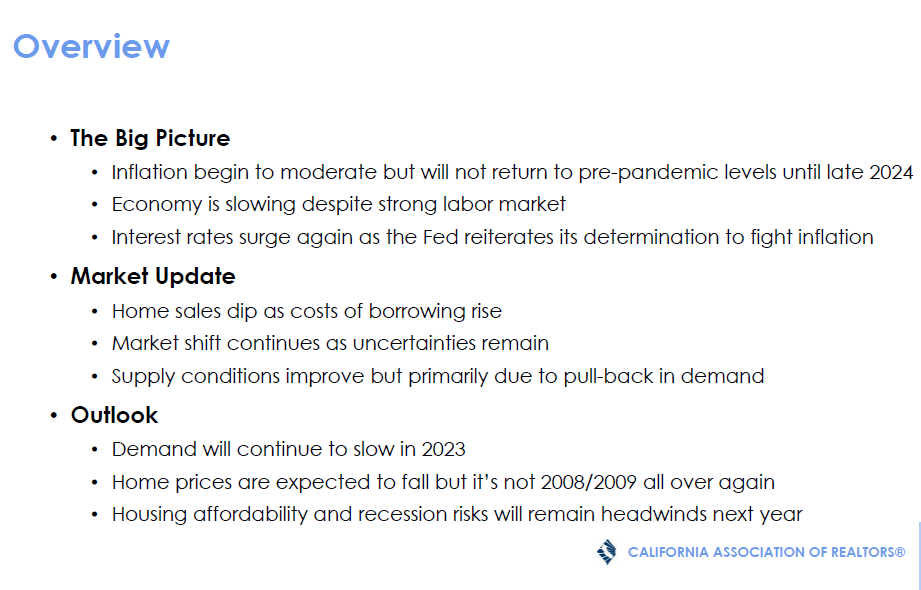

California Association of Realtors, in its October prediction for 2023, was somewhat stark in its prediction of the market and the economic factors affecting housing for 2023:

Julia Huntsman, REALTOR, Broker | http://www.juliahuntsman.com | 562-896-2609 | California Lic. #01188996

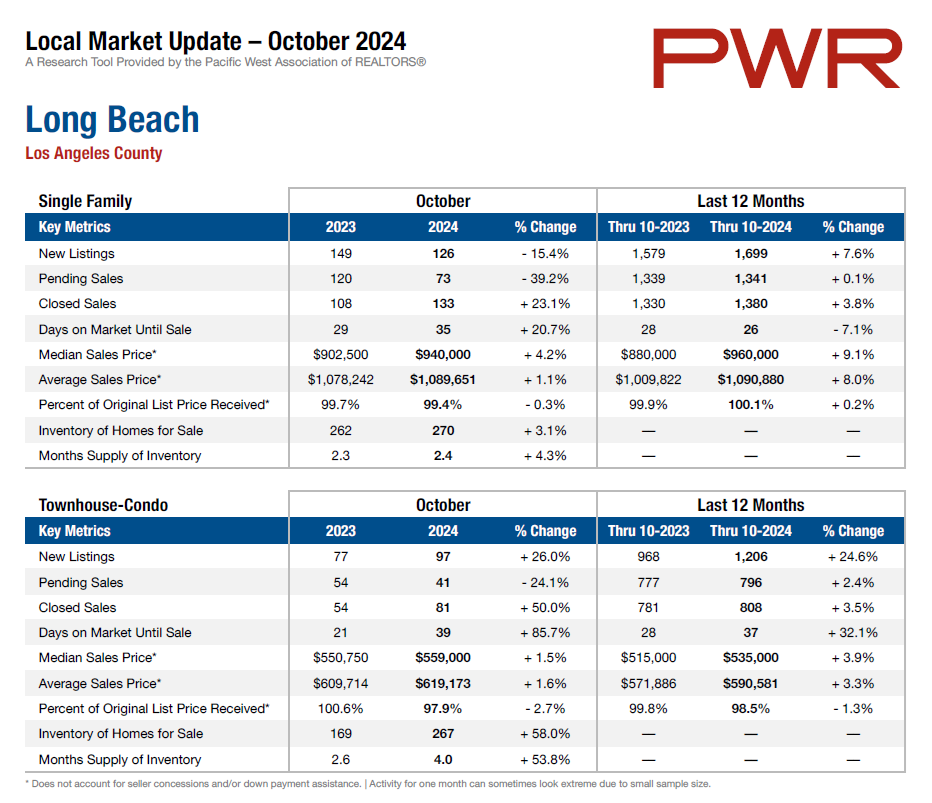

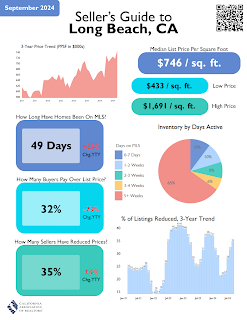

Your Market Info