Starting Out in 2023's Real Estate Market

As of mid December 2022, these are some of the conditions leading into 2023.

The labor market - There are two jobs for every job seeker, which puts pressure on wages, and ultimately creates higher prices for products.

Recession ahead - Most likely, maybe in the 2nd quarter of 2023. Mortgage rates fall typically with a recession, and an increase in demand follows.

Supply and demand wavered in 2022 - Inventory for single family homes still lower than prior to the beginning of the pandemic, in mid-December 1,000,000 homes were on the market per the National Association of Realtors.

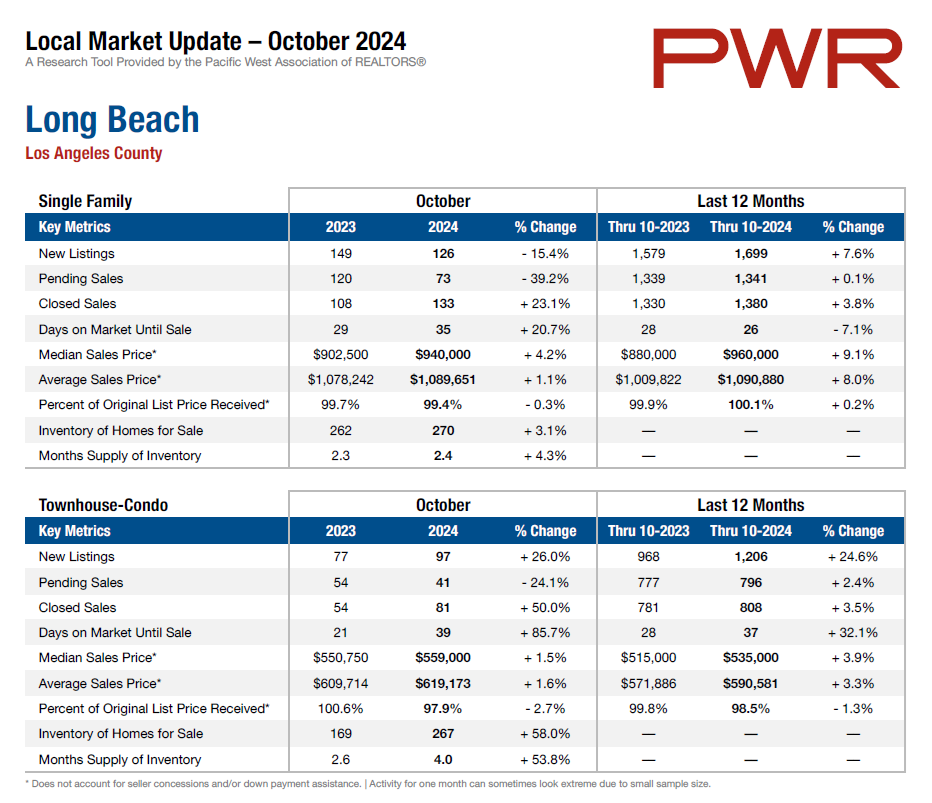

Southern California Counties inventory on market, 3-year average prior to COVID:

Los Angeles - 9,349 (down 11%)

Orange: 2,939 (down 36%)

Riverside: 6,115 (down 27%)

San Bernardino: 3,471 (down 21%)

Ventura: 851 (down 35%)

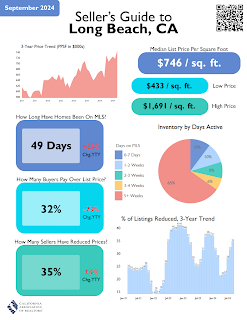

The average days on market for Los Angeles, Riverside and San Bernardino Counties were over 100 days.

Median Price and Mortgage Rates in Southern California:

By mid-December, interest rates went to below 6.5%, from a high of over 7 % a couple of months prior. The dark blue line shows the corresponding increase in monthly payment, and obviously there's been extreme changes in the rates since the beginning of 2022. Buyers are seeing the return of assistance programs in the form of grants (with conditions of course), and more sellers have been willing to do buydowns in rates for the buyers.

Buydown scenario:

$800,000 Price, 20% down, $640,000 loan amount, 750 FICO score, single family home. The mortgage only payment in Year One is $3,148; Year Two is $3,534, and $3,940 for Year Three and beyond. The seller contribution to buyer to make this happen is $14,400.

A survey by Lending Tree showed that 41% of Americans think that there will be a housing crash in the next 12 months (from November 2022). But in the words of Steven Thomas, Orange County Economist:

" The number one reason why a crash will not occur is a lack of available homes to purchase. When the inventory builds, it takes a lot longer to sell. When the unsold inventory rises above 300 days, negotiations lean heavily in favor of buyers and home values fall rapidly. The unsold inventory in Southern California, according to the California Association ofor 2022 in July at 99 days. In comparing today’s unsold inventory to the two years leading up to the Great Recession, 2006 and 2007, the difference is stunning. The unsold inventory peak in 2006 was 219 days, and it was 456 in 2007. Home prices are not tumbling at the rate they were in 2007-2008 when values sank by 40% ."

There is no panic selling and no forced selling in today's market, there are limited homes to sell because homeowners are choosing not to sell. Today's loan delinquency rate is at its lowest level in decades.

If you are thinking of making a change, please contact me for assistance in finding your home's value and how to prepare for a sale.

Julia Huntsman, REALTOR, Broker | 562-896-2609 | California Lic. #01188996

Your Market Info