8 Simple Rules for Negotiating Your Offer and Getting That House

By: HouseLogic

You and your agent are going to use everything you’ve learned to seal the deal.

Here’s the dream: Your offer is perfect, you don’t need to negotiate, and you can spend the next few weeks addressing more pressing home-ownership questions, like “Why is it called wainscoting?” and “Do I want a new couch in blush or emerald green?”

And it could happen. Many sellers accept the best offer they receive, and for a variety of reasons.

But sellers are also known to reject offers for a variety of reasons. Or make counteroffers. This is especially likely if you bid low, or when you’re up against multiple competing offers.

If you do receive a counteroffer, it’s up to you to decide whether you want to accept the new contract, negotiate the terms, or walk away.

In cases such as these, look to your agent. He or she is your spirit guide. If you decide you want to negotiate — that is, make a counteroffer to the seller’s counteroffer — your agent will use their negotiating skills to help get you the best deal. This is what agents do every day.

But you’re not just going to sit there. If you understand what negotiating tactics your agent may deploy — they depend on the local market and your position — you can back them up. And cheer them on.

Here are eight rules every buyer should know before they — and their agent — start negotiating:

#1 Act Fast — Like, Now

When you receive a counteroffer, you should respond quickly — ideally within 24 hours. The longer you wait, the more space you leave for another buyer to swoop in and nab the property. Also? If a seller senses hesitation, they may decide to withdraw their counteroffer before you even have a chance to respond.

#2 Raise Your Price (Within Reason)

While you obviously don’t want to overpay for a house, you may have to up the ante — especially if you initially made a lowball offer. Lean on your agent’s expertise to determine how much money you should add to the sales price to make it more enticing to the seller.

Then, through their powers of persuasion, your agent can make the counteroffer look even more attractive by pointing out similarly priced “comps” — recently sold homes in your area that are comparable in terms of square footage and features.

As your agent negotiates, it can feel like things are escalating quickly. It’s stressful. You may feel a sudden urge to do whatever it takes to win.

Before you go overboard, there are two things you must keep in mind:

- You can’t exceed the monetary confines of the pre-approved mortgage you received from your lender.

- You shouldn’t overextend your budget.

Because your counteroffer has to be an amount you’re comfortable spending on a home. You want that new house and to keep living your life. Plus: You’re not out of options yet.

#3 Increase Your Earnest Money Deposit

Increasing your earnest money deposit (EMD) — the sum of money you put down to prove to the seller you’re serious (i.e., “earnest”) about buying the house — is another way to show the seller you have more skin in the game. A standard EMD is typically 1% to 3% of the sales price of the home. Making a counteroffer with a 3% to 4% deposit could be what you need to persuade the seller to side with you.

#4 Demonstrate Patience About Taking Possession

Depending on the seller’s timetable, changing your proposed possession date — the date you take over the property — could butter them up, too. If the seller wants to stay in the home for a few days after closing, try offering a later possession date. You could also draw up a “rent-back” agreement, meaning the seller pays you rent for staying in the home for a set period of time after the closing date.

#5 Let Go of a Few Contingencies — With Care

Want to give your counteroffer an even bigger boost?

Reduce the number of contingencies you’re asking for. It’s your way of saying, “Hey, look, I have fewer ways to back out,” which gives the seller more reassurance that the deal will close.

But be selective: Some contingencies are too important to give up. A home-inspection contingency — the right to have a home inspection and request repairs — gives you an out if you spot major problems with the home (and protects you from buying a total money pit).

You might waive a termite inspection if you’re in a state where the risk is lower.

But ultimately, waiving contingencies depends on your market, your loan program requirements, your risk tolerance, and the circumstances of the house in question. And if you waive contingencies and then you find a problem, the seller isn’t responsible for fixing it.

#6 Ask for Fewer Concessions

At a mortgage settlement, home buyers have to pay closing costs for taxes, lender’s fees, and title company fees. Closing costs vary by location, but you can expect to shell out between 3% and 4% of the home’s sales price. The seller pays an additional 1% to 3%. (Smart Asset and Nerdwallet have simple calculators you can use to get a rough idea of what your closing costs might be.)

When making an initial offer, you have the option to ask the seller for concessions — a settlement paid in cash to help you offset your share of the closing costs. (This move is less feasible if you’re going up against multiple offers.)

Concessions effectively lower the seller’s net proceeds from the sale. Making a counteroffer that removes the concessions you would have otherwise received at settlement puts cash back in the seller’s pocket — and can improve your bid.

#7 Pick Up the Cost of the Home Warranty

Sometimes sellers offer prospective buyers a home warranty. This is a plan that covers the cost of repairing major home appliances and systems, like the air conditioner or hot water heater, if they break down within a certain period (typically a year after closing).

A basic home warranty costs about $300 to $600 a year, according to Angie’s List. If it seems like waiving the home warranty can sweeten negotiations, but you still want the peace of mind of having one, tell the seller they don’t need to cover it — then buy it yourself.

Just keep in mind, whether you or the seller buy the warranty, you’ll need to pay the service fee (typically between $50 and $100) if something does, indeed, need to be repaired while under warranty.

Also, FYI: A home warranty is entirely separate from homeowners insurance. Homeowners insurance — the security blanket that covers your home’s structure and possessions in the event of a fire, storm, flood, or other accident — is required if you take out a mortgage. It can cost anywhere from $300 to $1,000 per year.

#8 Know When to Walk

When negotiating with a seller, trust your gut — and your agent. If he or she says a deal is bad for you: Listen.

And if you don’t want to make any more trade-offs — and the seller won’t budge — it’s smart to walk. That can be a tough decision to make, and rightfully so! Negotiating is tough. It’s draining.

And losing something you’ve worked hard to get can be disappointing. But don’t worry. There’s a better deal for you out there. And after those strong feelings of frustration pass, you’ll realize: Now I know how to do this.

Choosing the proper agent will ensure you make the best decisions in your new home purchase.

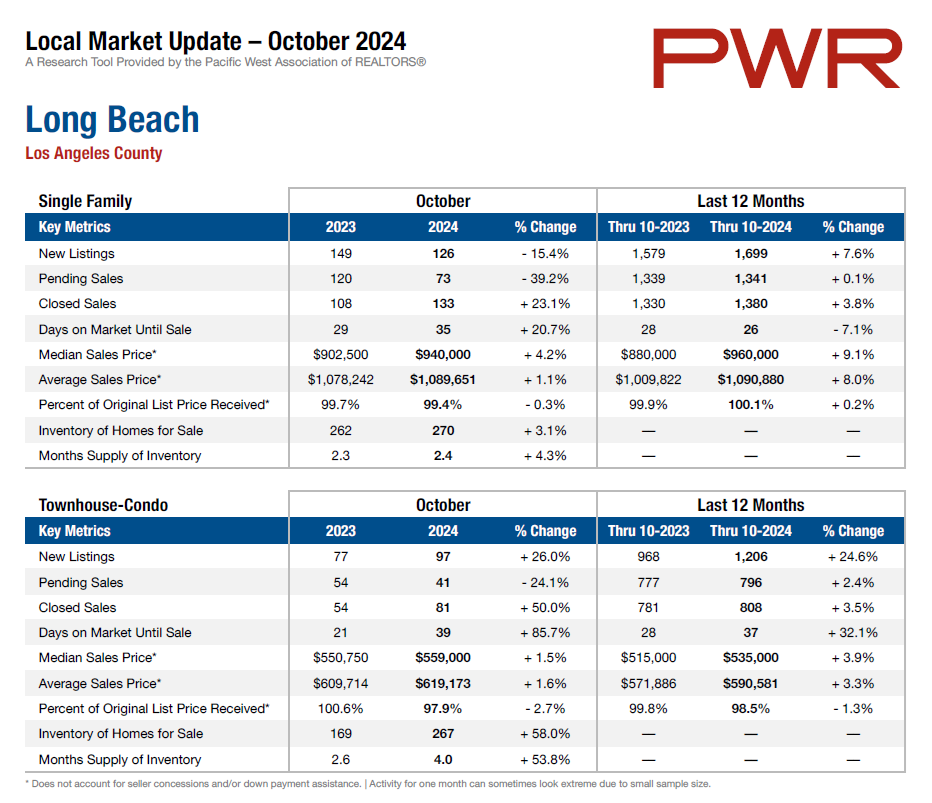

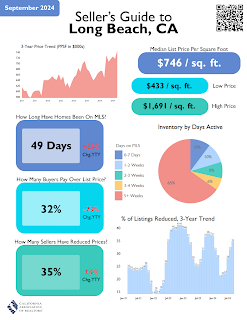

Your Market Info