How to Prevent (Home) Buyer’s Remorse

By: Lynn Ettinger

You can make a successful offer on a home even in a competitive market — with the right information and help.

When you’re house hunting, the pressure of competition can move you from “Hmm, I like that, but it’s too pricey,” to “I have to have that!” You think, so what if paying for this house will put me way over budget? I can cut back somewhere else, right? But that kind of thinking can get you into trouble. Trouble that’s totally avoidable.

Whether you’re in the middle of a home bidding war or facing down a list of must-haves, don’t lose sight of your budget and the risks. That way, you can own a house without home buyer’s remorse. And you’ll have money left to enjoy things like new furniture, entertainment, and just plain having fun.

Who Has Home Buyer’s Remorse and Why?

A competitive real estate market can set buyers up to purchase a home that’s either beyond their budgets —sometimes hugely beyond — or doesn’t meet their needs, according to a 2021 survey by Bankrate and YouGov. The survey found that recent home buyers, including 64% of millennials, had regrets about their home purchase. The top reason? They were unprepared for maintenance and other home ownership-related costs. On top of that, 13% percent of millennials said they think they paid a higher sales price than they should have.

“Things in homes always break down, so people should put aside a budget for anything that will need fixing,” says Lawrence Yun, chief economist at the National Association of REALTORS®. “A rule of thumb is to anticipate 1% or 2% of the home price for potential maintenance,” he explains. “So, for a $300,000 home, that means setting aside $3,000.”

One reason home buyers may be tempted to go over budget is they’ve been influenced by the beautiful homes on TV, according to an NAR report on home staging. “The shows can create unrealistic expectations for the home buying process and how homes should look,” says Brandi Snowden, NAR director of member and consumer survey research. In time, buyers can view features that used to be luxuries as necessities. They believe everyone has them and they should too. One solution: Work with a REALTOR as early as possible in the process. “Make sure your agent knows your budget, so they can help you set expectations and stick to them,” she advises.

How to Navigate House Hunting in a Competitive Market

In addition to pressure to exceed their budgets, buyers are facing hurdles like these five:

1. Requests to Waive Contingencies

Tamara Suminski, a real estate agent at Beach Real Estate Group in Manhattan Beach, Calif., is seeing not only bidding wars but also sellers wanting buyers to waive contingencies. “With an appraisal contingency, if the appraisal comes in low, the buyer has choices. They can choose to try to renegotiate with the seller, bring in the difference, or cancel. When they remove that contingency and its protection, and if the home doesn’t appraise at the right level, the seller is not very likely to renegotiate with them. And the buyer has waived their right to cancel. If they cancel anyway, they’re risking their deposit.”

Some buyers are also waiving contingencies related to home inspections. These investigations are an opportunity to have a home inspector view the home based on disclosures and for the buyer to use findings as a bargaining tool, Suminski says.

Eliminating these protections can end up costing money for buyers. And the more offers the buyer writes and loses, the more risk they will tolerate. So, they may waive contingencies and regret it later, says Suminski. Talk to a buyer’s agent who will guide you through this and explain the risks of removing protections and unknown variables, she advises.

2. Speed Showings and Decisions

Bryan Yap recently bought a home in an expensive and highly competitive market — Orange County, Calif. He found that with the pandemic, each showing lasted only 15 minutes. That was one of the biggest hurdles. “We’d see three, four, or five homes in one day. It’s hard to keep track of what you like and don’t like with each house. What I would do differently is take notes immediately after viewing a home. If you’re able to prepare beforehand, create a list of wants and requirements in priority order. Immediately after seeing each home, rank it based on the list.”

3. Focusing on the Top of Your Price Range

“If you’re looking in a micromarket where listings are achieving multiple offers and homes are going above asking price, don’t set your on the houses at the top of your price range,” Suminski says. If $300,000 is your upper limit, look at houses priced at $250,000 or $275,000. Otherwise, you’re going to be outbid from the gate every time.”

That was the process Yap used when he was looking. “I would look for homes $25,000 under my max budget. I went on Zillow and looked at homes that were sold recently and tried to calculate the average over-listing price those homes were being sold for and factor that into my offer price.”

4. The Need to Compromise

Yap’s must-haves were three bedrooms, two baths, and being closer to the city center of Anaheim. “I was able to get three beds, two baths, but I did have to compromise on location. I also had to compromise on price, which was doable because I could still afford it. To compete with all the potential buyers, I knew that we had to either offer an over-list price or remove some contingencies.”

Suminski advises adjusting your search outward geographically, even if it means a longer commute. Buyers might also have to compromise on property types and features. In addition, they should consider doing some DIY projects instead of wanting everything to be move-in ready. “They may have to be willing to look at townhouses instead of single-family homes or install carpet and paint on weekends.”

5. Information Overload

In the two years before he started searching for a home, Yap did a lot of reading. “It was a massive plan I had to come up with and stick to so that I’d be able to afford buying a home.”

Because of how hot the Orange County market is, agents scheduled showings as soon as a house was listed or showed “coming soon” status. Yap treated the home search as “almost a second job,” using lunch breaks and evenings to check emails, do online searches, and text his real estate agent about what he wanted to see. “I had to make a lot of sacrifices. People wanted to set plans with me for the weekend, but I said, ‘Sorry, I have to go view homes that day.’”

He primarily credits his real estate agents, including Sumiski, for keeping him informed. “They made all this possible. I learned a lot from them.”

Some agents, like Suminski, hold an accredited buyer’s representative designation but usually work with sellers as well as buyers. “An [agent with an] ABR has taken extensive buyer’s representation training,” Suminski says. “They’ll provide education to buyers so that they’re learning as much as they can about the market, including the risks involved with different negotiations. If buyers are going to shorten terms or remove protections, they need to be well informed about the pitfalls.”

Learn from Experiences

That access to information and guidance will help buyers making an offer on a home especially in a competitive market. “Today’s buyer has seen and written offers on many properties before they get their offer accepted,” Suminski says. “That’s common across the country. Each is a learning opportunity for buyers about what information they might need to be researching so they can move more quickly.”

When you act on advice from recent buyers and agents, you can stay well informed and get good results even in a tough market. And that’s the best way to prevent home buyer’s remorse.

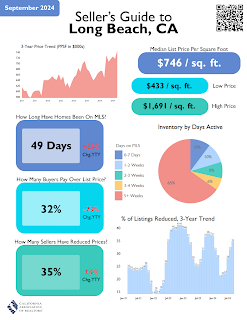

It’s been a rough ride for homebuyers lately, as prices have hit the roof with little respite. All of that looks to change soon.

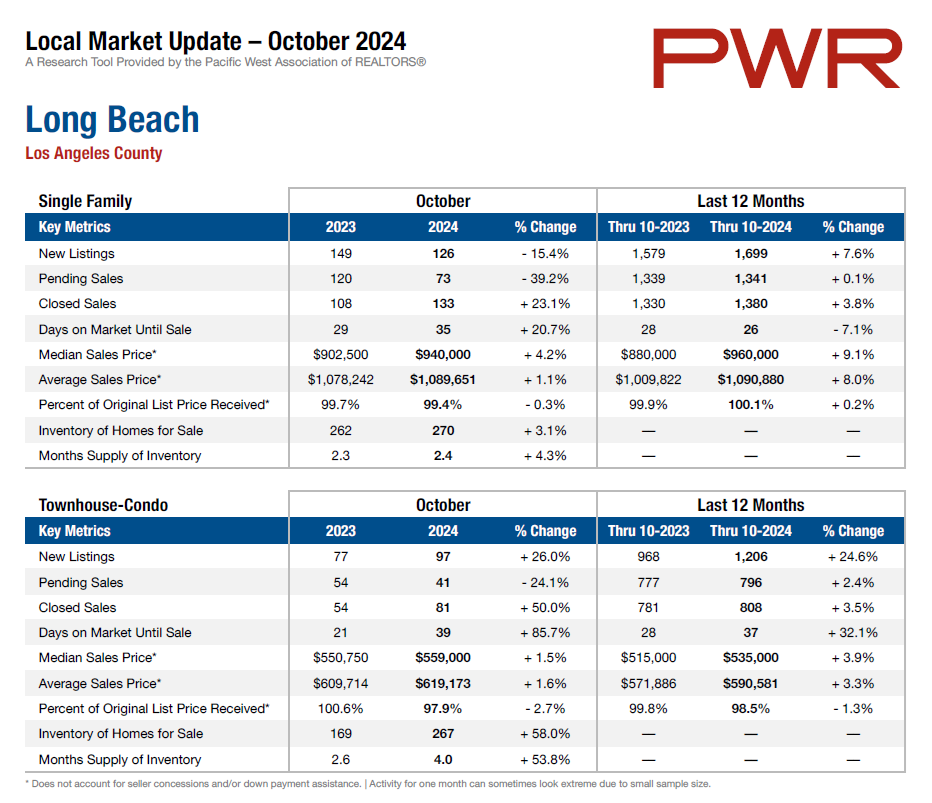

Your Market Info